Simple Strategies for Automating Your Finances

Cut stress and build wealth with easy, low-maintenance money systems. Learn quick steps to automate bills, savings, and investing—safely and smartly.

Retirement Basics: Start Early, Stay Consistent

Unlock a secure retirement by starting early, investing consistently, and letting compounding work—small, steady steps beat last‑minute sprints.

Beginner's Guide to Investing on a Modest Income

Start investing on a modest income with simple steps: set goals, build an emergency fund, automate small contributions, use index funds, and avoid high fees.

Cutting Everyday Expenses Without Cutting Joy

Trim costs without trimming happiness. Use mindful swaps, smart planning, and habit tweaks to save money while keeping the experiences you love.

The Psychology of Spending: Taming Impulse Buys

Impulse buys aren't just weak will—they're brain wiring. Learn the triggers behind overspending and practical steps to regain control.

Debt Snowball vs. Avalanche: Choosing Your Payoff Path

Unsure whether to tackle debt with the snowball or avalanche method? Learn how each works, when to use them, and how to pick the best fit for you.

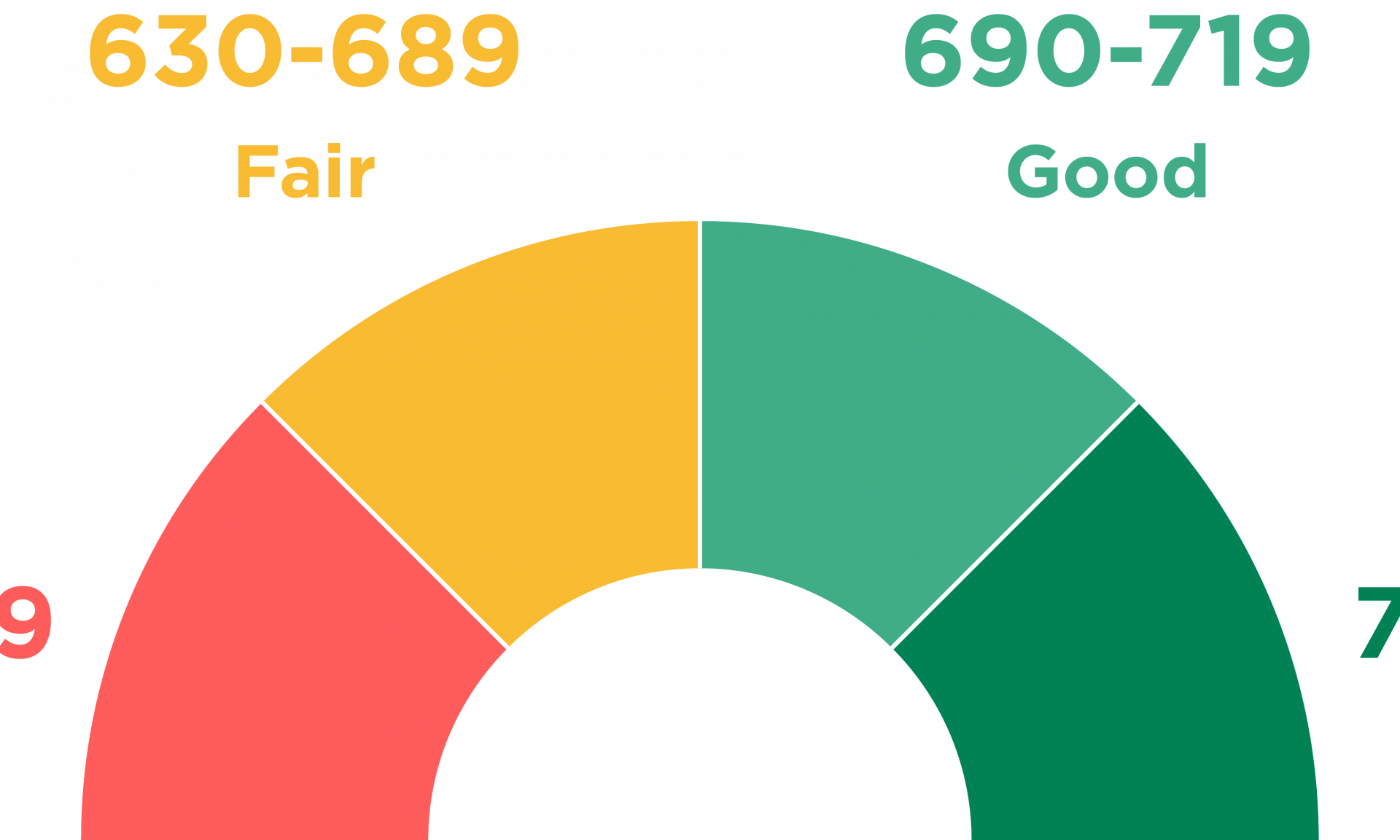

Demystifying Credit Scores and Reports

Learn how credit scores are calculated, what appears on your reports, and smart steps to monitor, dispute errors, protect your identity, and raise your score.

Smart Saving Habits You Can Start Today

Start saving smarter today: automate transfers, track spending, build an emergency fund, pay yourself first, trim bills, and set clear, realistic goals.

How to Build an Emergency Fund Without Feeling Deprived

Build a strong safety net without sacrifice: small automations, painless cutbacks, and smart banking habits that grow your emergency fund fast.

Negotiating Bills and Subscriptions Like a Pro

Cut monthly costs without cutting quality. Learn proven scripts, timing, and tactics to negotiate lower bills and subscriptions fast.

How to Set Money Goals You'll Actually Reach

Turn vague money wishes into targets you'll actually hit. Tie goals to your values, set SMART numbers, automate, and review weekly.

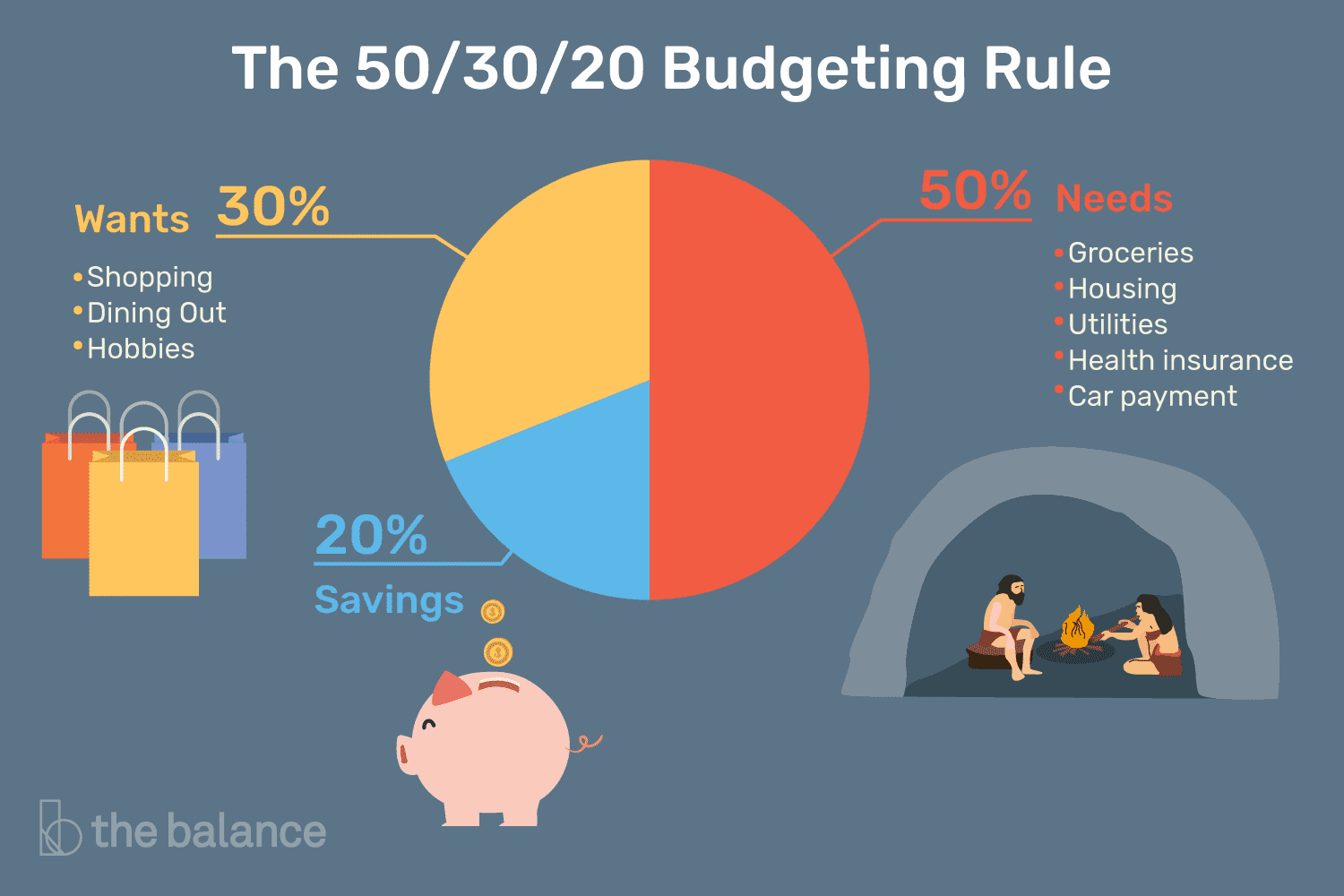

Mastering the Monthly Budget: A Simple Framework

Build a stress-free budget in five steps. Use clear buckets, automate transfers, and adjust monthly to stay on track without spreadsheets.