Mastering the Monthly Budget: A Simple Framework

Build a stress-free budget in five steps. Use clear buckets, automate transfers, and adjust monthly to stay on track without spreadsheets.

Clarify Your Why: A budget works best when it is anchored to reasons that matter to you. Start by defining a handful of clear goals that reflect your values: stability, freedom, learning, or family. Translate each goal into a monthly target, even if it is small. For example, commit to a fixed amount for an emergency fund, another for debt payoff, and a little for a future treat to keep motivation high. Write a one-sentence statement of purpose so choices feel easier when trade-offs appear. When you're tempted to overspend, contrast the impulse with your stated purpose. Keep your framework simple: identify your needs vs. wants, protect the essentials, then direct the rest toward what moves you forward. The goal is not perfection; it's consistent progress. Think of your budget as a compass, not a cage. With a clear why, every decision becomes a chance to align money with meaning, and momentum naturally builds.

Map Cash Flow: Before changing anything, map where money actually goes. List all income sources and categorize expenses into fixed costs (rent, utilities, insurance), variable spending (groceries, transport, dining), and periodic bills (subscriptions, car maintenance, gifts). Scan the last few statements to find patterns and average amounts. Include small purchases; they often reveal useful trends. Add a category for one-off or seasonal expenses so they stop surprising you. If numbers feel fuzzy, track a week with a quick daily note, then extrapolate for a month. The goal is clarity, not blame. When you see the full picture, you'll spot easy wins: unused subscriptions, double charges, or category creep. Consider a simple naming convention so every expense has a home. With a clean map, you can guide money intentionally, reduce waste without feeling deprived, and set realistic targets that your future self can actually maintain.

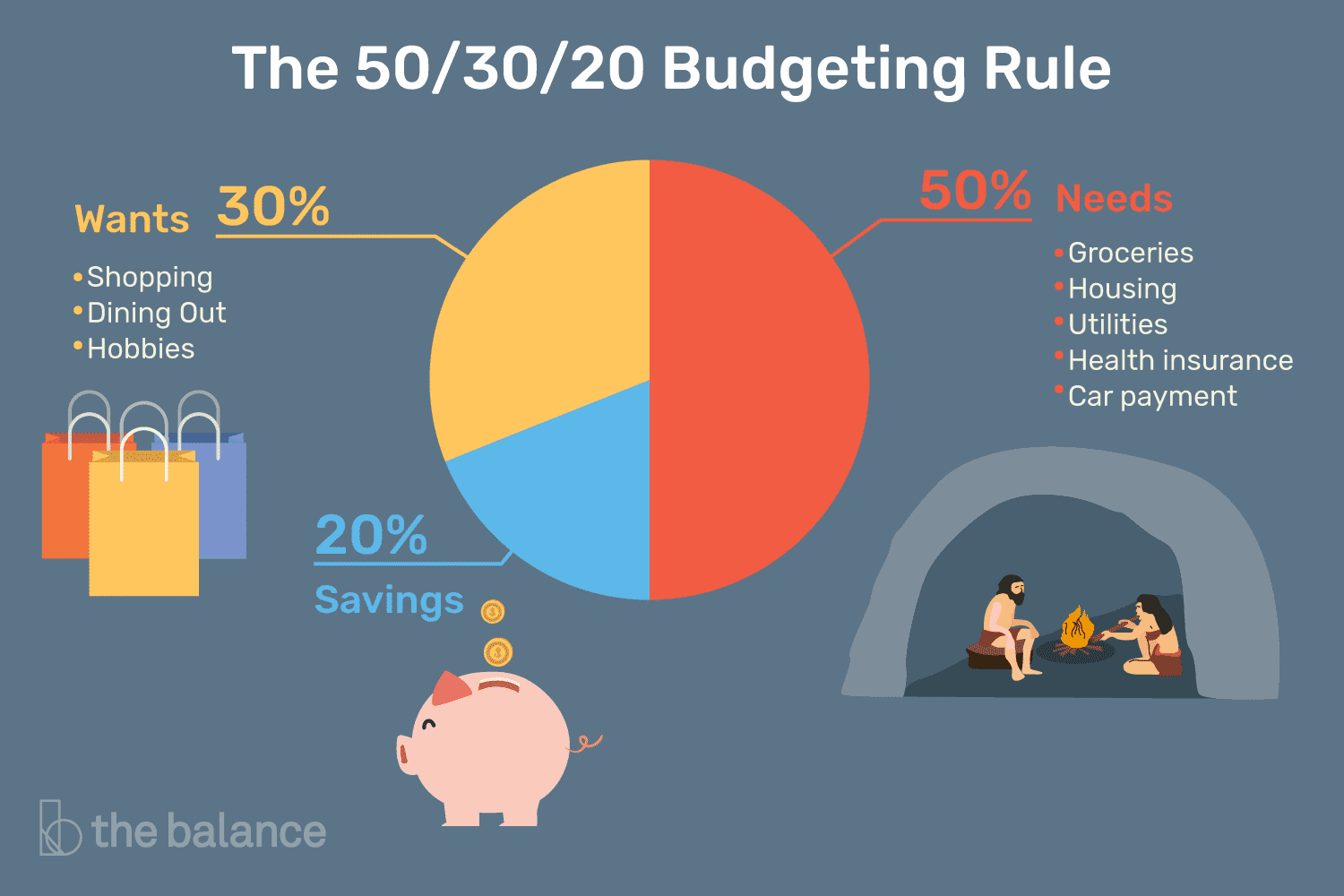

Plan by Percent: Create a simple blueprint using broad percentages so the plan scales with your income. A classic starting point is something like 50 percent for needs, 30 percent for wants, and 20 percent for saving and debt payoff. Adjust based on your reality: high cost of living might push needs higher, while a debt sprint might lift payoff temporarily. Always pay yourself first by funding savings, sinking funds for predictable big costs, and minimum debt payments before flexible spending. Direct extra money to a chosen strategy such as debt avalanche (highest interest first) or snowball (smallest balance first) to keep momentum. Keep categories broad to avoid decision fatigue, then track a few hotspots more closely if needed. The aim is a resilient structure that survives messy months. When inflows change, percentages hold the shape, making your plan adaptable, simple, and transparent.

Spend with Guardrails: Use practical rules to keep spending aligned without constant willpower. Give each flexible category a clear limit, and break it into weekly portions to prevent mid-month shortfalls. Try a light envelope method (physical or digital) for groceries, dining, and fun, where the remaining balance is always visible. Employ a 24-hour rule for non-essentials to curb impulse buys, and shop with lists to reduce friction. Calendarize upcoming expenses so nothing sneaks up on you, and keep a small buffer category to handle tiny surprises without chaos. When you do spend, favor quality and cost per use over quick bargains that disappoint. Plan small treats so you don't feel deprived; the goal is sustainability. Review your hot zones weekly, then make a single adjustment if something drifts. Guardrails turn your plan into daily decisions you can trust, protecting progress while leaving room for a satisfying life.

Automate and Protect: Make the default choice the right one with automation. Schedule transfers to savings and sinking funds right after payday, then set up autopay for stable bills to avoid late fees. Use bank alerts for low balances, large transactions, and due dates to catch issues early. Start with a basic emergency fund—even a small cushion stabilizes your plan—then grow it as your capacity improves. Consolidate accounts where possible to reduce complexity, and keep a separate, boring place for your emergency cash so it stays untouched. If debt is part of the picture, automate at least the minimums, then add targeted extra payments when income lands. Simplify your toolset: one spending card, one savings hub, one tracking routine. Friction shrinks results; automation expands them. Protect your progress with secure passwords and mindful online habits. A streamlined system reduces stress, frees time, and makes consistent good choices almost effortless.

Review and Improve: Create a short monthly review ritual to keep your budget alive. Reconcile income and expenses, compare results to your targets, and ask three questions: what worked, what drifted, and what needs adjusting. Move leftover category balances to priorities like debt payoff or savings to reinforce progress. If a category overshoots consistently, raise it honestly and reduce a lower-value area; accuracy beats wishful thinking. Scan for seasonal expenses and add or increase sinking funds so future you is protected. Note any windfalls or setbacks and decide in advance how to handle them with simple rules. Track a few metrics—savings rate, debt balance trend, emergency fund size—to see momentum. Celebrate small wins; motivation compounds. As your skills improve, raise your savings or investment contributions by a small automatic bump. The review closes the loop, turns data into decisions, and transforms budgeting from a chore into a confident, repeatable habit.