3 min read

240 Views

Editorial Staff

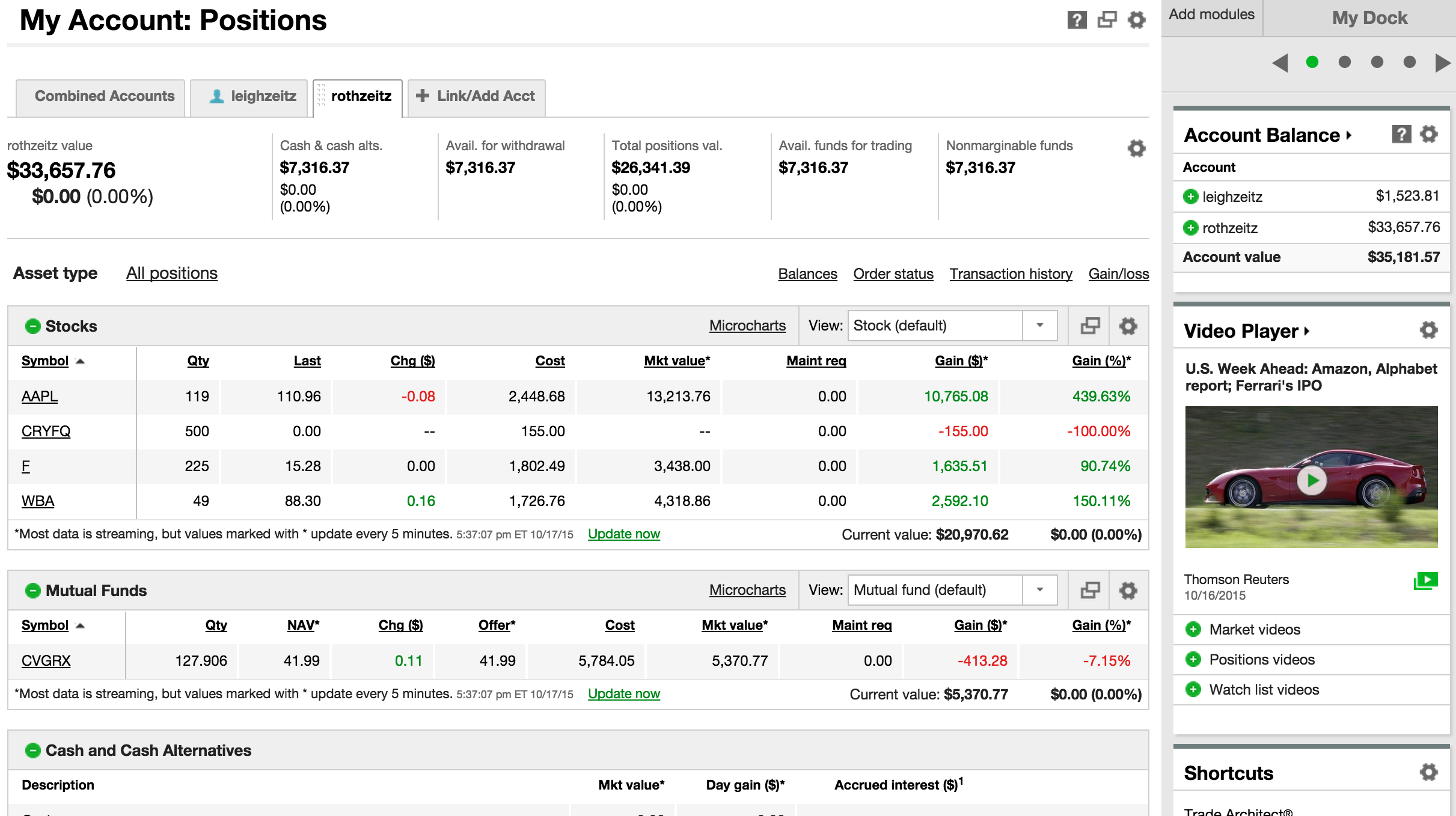

Roth IRA Calculator; what is it?

The assumption by this Roth IRA is the regular contribution done at the end of each period, either monthly or [...]

T

he assumption by this Roth IRA is the regular contribution done at the end of each period, either monthly or yearly.

This is one category of Individual Retirement Arrangement-IRA that offers tax-free growth. Roth IRA differs with traditional IRA on the basis that:

Savings to a Roth IRA scheme do not attract tax deductions

Withdrawal of direct contributions to Roth IRA are done any time under tax free condition and without any penalty.

Upon retirement, Roth IRA will unconditionally offer a tax-free income. In as much as there is no tax deductions imposed on funds kept under a Roth IRA, the sweet benefits will come later. Therefore, a Roth IRA becomes a useful tool for somebody who anticipates to fall under a higher tax band in retirement than in better part of his working life.

Contributions to a Roth IRA;

A large percentage of middle-income Americans qualify to make contributions to a Roth IRA. For you to make contributions in a given year, then you must have earned some income-whether tips, wages, self-employment income or bonuses amongst others. For 2015 and 2016, the contribution limit as set at $5,500 for persons aged 49 and below; and $6,500 for those aged 50 and above.

Roth IRA distribution;

Upon attaining the age of 59.5, you are at liberty to start withdrawing tax-free allocations from your Roth IRA- given that you had kept your contributions for at least five years.

Observation of the five-year rule is very crucial. In most cases, people set up their Roth IRAs at early times in their working life. For many years, they make contributions and therefore the five-year principle is not a major issue per se. a possibility of converting from conventional IRA to a Roth IRA exists. However, conversion tax rules are complex and stringent but they have to be followed to the letter.

The Roth IRA calculator can easily be obtained from calculator.net if you don’t have it installed in your mobile device or PC. The calculator assists you estimate your contribution balance and interest saving to Roth IRA.

Definitions used in the Roth IRA calculator;

Starting balance- refers to the most current balance status of your Roth IRA

Annual contribution- is the sum amount deposited to your Roth IRA annually

Current age- your present age

Retirement age- when you purpose to retire. After retirement, the calculator makes an assumption that you cease from placing any deposits to your IRA. For instance, if you retire at 62, it is assumed that your last contribution was at age 61.

Expected rate of return- the calculator presupposes that your contributions are done at the start of each year and therefore your return will be compounded annually. Different rates of return are set every year.

[photo: www.flickr.com]