2 min read

245 Views

Editorial Staff

Roth IRA Calculator, use the calculator

This article explains how Roth IRA calculator works, factors considered and the assumptions made to use the calculator. Funds deposited [...]

T

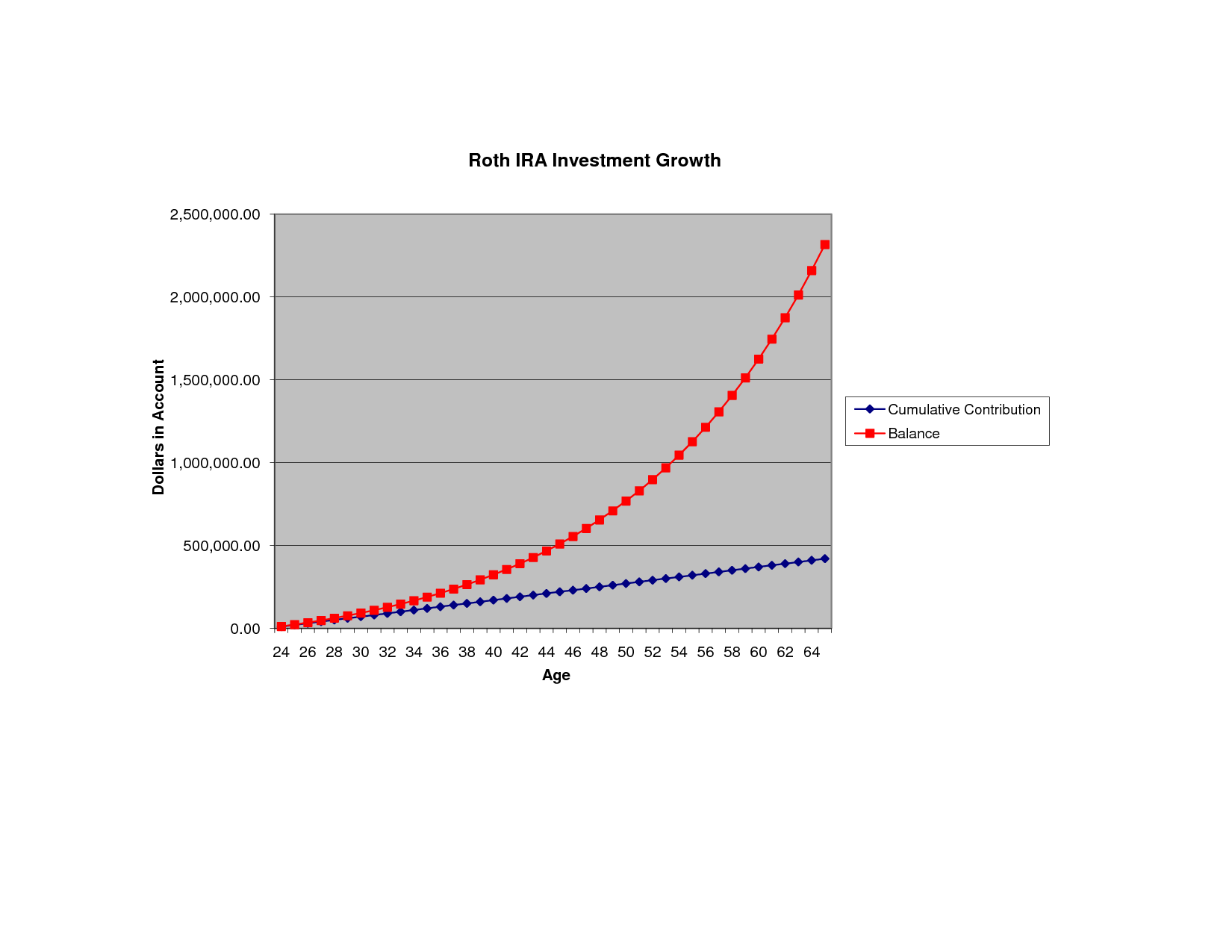

his article explains how Roth IRA calculator works, factors considered and the assumptions made to use the calculator. Funds deposited in a Roth IRA are not subject to any deduction in form of taxes and this usually benefits people who have expectations of having lower tax bracket in their working life than in retirement. For Roth IRA calculator, low earning workers would get a deduction of tax mostly on the money contributed to Roth IRA. According to the Roth IRA calculator many middle earning people are eligible to make contributions to the Roth Ira. Roth IRA calculator helps individuals to compute the savings amount to be made to Roth IRA inclusive of the payment of taxes so as upon retirement the individual receives the money tax free. In a Roth IRA calculator, the annual deposit is usually entered in the before tax column so as to compute the deposit amount after tax. Making use of the Roth IRA calculator makes a huge difference in the amount of savings meant for retirement. The Roth IRA calculator computes the amount to make for the savings based on the starting balance which is the present balance an individual has in the Roth IRA. Also, it basis on the annual contributions and it makes an assumption that the contributions are made at the start of each year. The Roth IRA calculator limits contributions the amount of income. An individual1s incomes falling in the phase out interval will call for the contributor to have a prorated Roth IRA towards his contribution. The Roth IRA calculator makes an assumption that an individual`s income cannot limit him from contributing to the Roth IRA. Also, it assumes a compounded annual rate of return which is mostly dependent on the investment type the contributor selects. The last year of retiring is not included in determining the contributions made.