2 min read

197 Views

Editorial Staff

Refinance Calculator - Does it Really Work?

While people's advice may vary, the only way to make sense of your personal situation concerning the essence of refinancing [...]

W

hile people's advice may vary, the only way to make sense of your personal situation concerning the essence of refinancing is to get a refinance calculator. The calculator helps home owners decide if refinancing is a viable option for them because what works for one person may not be the best solution for another.

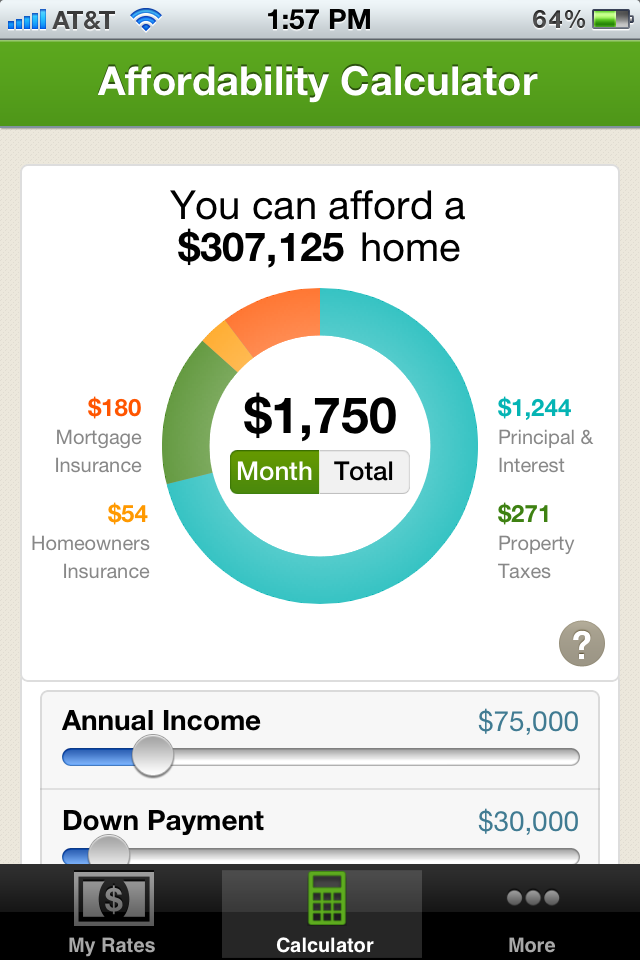

The basic function of these unique calculators is to help the home owner adjust his or her mortgage payment. The decision to refinance is influenced by a number of factors. The calculator can indicate that when you lower the cost of paying your mortgage on a monthly basis you will still be able to meet the payment deadline and cover your debt within a reasonable time frame. If this is the case then considering the refinancing option is a great thing to do.

Apart from this assessment, the calculator offers you relevant information of how the adjusted payments will be applied to the principal loan and interests as time goes by. There are few aspects that you must understand if the calculator is to be useful to you.

What is down payment?

This refers to the amount of money you secure towards the down payment of the house you intend to buy. It is always advisable to have extra cash after paying the down payment since this will cover any emergencies and repairs.

Interest rate charges

The interest rates refer to the rate that your loan receives as payment to the borrower. The rate in most cases is fixed meaning that your calculation for a refinance will be made easier.

Taxes

The calculations made encompass the property tax estimates. This value is a representation of home owner's annual property tax contribution. This tax amount is based on the value of the home. It is always proportional to the home's value.

Home insurance

One of the significant things that this calculator works on is the hazard insurance. Most lenders need proof that the home owners will protect the property against a number of events including natural disasters and burglary just to mention a few. It is important therefore to consult your refinance calculator before making any decisions.

[Photo: flickr.com]